In my year as a contractor at Capital One, I led the design of a major feature for the CreditWise app, with a second feature currently in development. I also drove the release of three new user flows within the credit line experience of the main Capital One app.

Below is a case study showcasing my work on the CreditWise credit score simulator, from concept to launch.

CreditWise by Capital One is a free credit monitoring tool that helps users track their credit score, receive real-time alerts, simulate the impact of financial decisions, and monitor identity risks all without affecting their credit. It’s available to anyone through a secure, user-friendly mobile app.

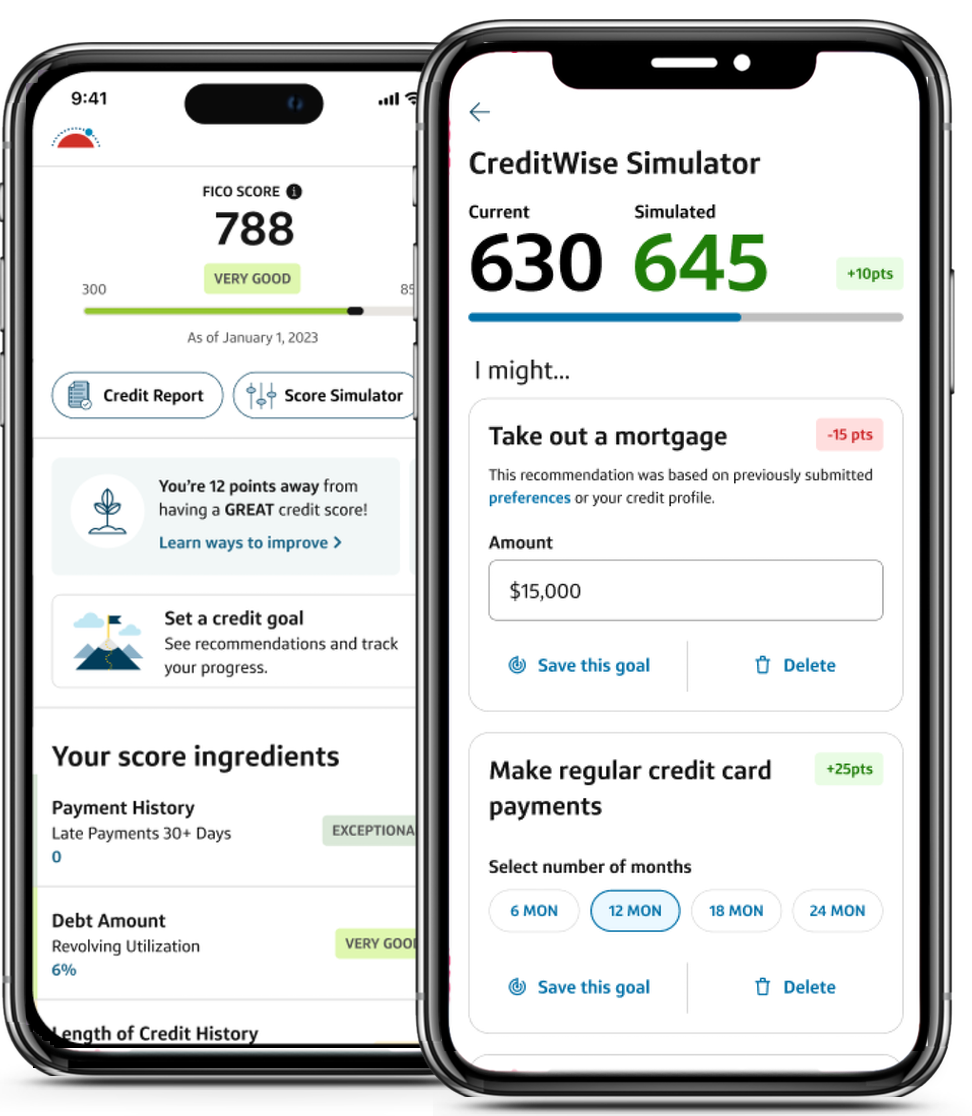

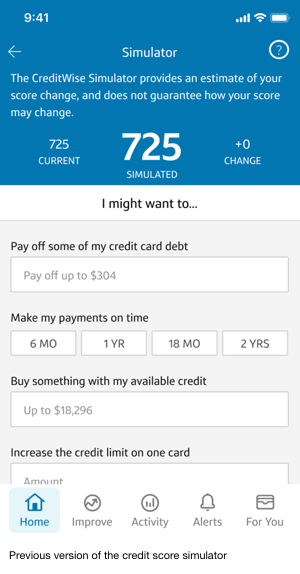

The CreditWise simulator lets users model how financial decisions, like paying off debt or opening new accounts, could impact their credit score. It’s a simple, interactive tool designed to promote informed, confident financial choices.

There were a few reasons why the feature needed updating:

As the lead UX designer on this project, I was responsible for reimagining the simulator experience to make it more intuitive, engaging, and aligned with modern design standards. The goal was to help users better understand how financial decisions might impact their credit score, through a tool that felt both informative and approachable.

I began by reviewing user feedback, analytics, and conducting interviews with internal stakeholders who had deep knowledge of the feature and its history. These conversations helped surface key challenges, many users struggled to interpret the impact of their changes, and overall engagement with the simulator was lower than expected. The interface felt outdated and wasn’t optimized for mobile, which made up the majority of traffic.

From this research, I identified key areas for improvement:

To explore different ways of making the simulator more intuitive and engaging, our team developed three distinct design concepts, each offering a unique approach to layout, interaction, and visualizing score changes. These ranged from a simplified, linear flow to a more exploratory, card-based interaction model.

For the design I was responsible for, a multiple selection - card based UI, I used Figma’s built in variable system to create a highly realistic, dynamic prototype with micro-animations to help guide the experience. This allowed users in testing to adjust inputs, like debt payments or credit utilization, and immediately see simulated changes in their credit score, closely mimicking real product behavior.

These prototypes enabled quick internal alignment and gave us valuable insights during usability testing. By comparing the three concepts, we identified which elements best supported clarity, engagement, and confidence in decision-making.

As part of a collaborative team effort, I helped design and revise three rounds of user tests, using usertesting.com, for each prototype we developed. These were unmoderated usability sessions aimed at evaluating our design direction that gave us summaries and data breakdowns, as well as video recordings of the sessions. We analyzed the video results together to identify which elements resonated with users and which needed improvement. The feedback consistently showed that elements of the updated experiences felt more transparent and empowering, users could understand the cause and effect of their actions in real time, which encouraged them to explore multiple scenarios more confidently.

I worked closely with developers to ensure our designs were implemented as intended, providing responsive specs, addressing edge cases, and adapting when components were limited or unavailable due to the rollout of a new design library. Collaboration extended beyond engineering; I partnered with product stakeholders to align on goals and define success metrics. I also worked with accessibility and legal teams to ensure our solutions met compliance standards and were inclusive to all users. Throughout the process, our designs went through multiple rounds of roundtable design reviews, allowing us to gather diverse feedback and iterate with confidence.

The project was nearing release when I left the company, and I’m looking forward to seeing performance data soon to understand how the design is resonating with users in the real world.

During my time at Capital One, I also contributed to the design of another major new feature for CreditWise, which launched to 5% of users as part of a phased rollout. I also played a key role in initiating follow-up improvements that were added to the development pipeline for future releases.

In addition, I led the design for three significant features within the credit line section of the Capital One mobile app. This involved close collaboration with stakeholders and developers to ensure smooth integration of the new design system. I helped guide decisions on when to apply the updated design library versus maintaining legacy standards to support ongoing development timelines and technical feasibility.